Sandilands Road, Singapore – March 21, 2022 —

Recently, NodeDAO announced that it will reduce comprehensive costs and enrich product service categories through platform-based SaaS and personalized customization of insurance products, improve product risk control level and promote the development of DeFi insurance ecology.

Breaking the Application Bottleneck with NodeDAO Personalization

While DeFi insurance is regarded as an important part of DeFi application, currently several major obstacles are encountered:

Single Insurance Product: Currently DeFi Insurance is mainly a hedge regarding the security of the category of contracts, while users have various asset security needs, and more diversified products can be developed in the future.

No Cross-chain Insurance: Currently insurance is often only available for mainstream DeFi projects on one chain, and it is not yet possible to provide cross-chain DeFi insurance. With the rising of multi-chain ecologies such as DOT and ATOM, the demand for cross-chain insurance will grow day by day.

Unavailability of Insurance Services for New Projects: Many new DeFi protocols have the demand for insurance services, but they are often unavailable to their users. This is not conducive to either the growth of DeFi or the expansion of the insurance market size. Currently, there are over 2,000+ programs in the DeFi marketplace and only about less than 30% are covered by insurance services offered on Nexus Mutual. In other words, the remaining approximately 70% or so of DeFi agreement subscribers have no access to its insurance services.

License Required: Users such as Nexus Mutual require full KYC verification to access insurance services, and many countries globally are not eligible to access the services. A total 17 countries, including Japan, India and Mexico, are currently unable to access the services. Therefore, a large percentage of DeFi users are kept out.

Low Insurance Capacity: On Cover or Nexus Mutual, many agreements feature low insurance capacities, indicating that the amount of funds available to provide insurance services is extremely low, and there are many agreements on Cover with less than even USD 1 million of insurance capacity. This makes it difficult to provide services to users in demand and is not conducive to the expansion of the DeFi insurance market.

Besides the poor infrastructure, these barriers directly or indirectly result in problems such as high cost and inefficient use of capital for DeFi insurance, making no breakthrough in the application of this niche track in the last year. And NodeDAO can achieve the platform-based insurance SaaS, which enables partners to open their own insurance products without any development work, which not only greatly expands the variety of insurance products to satisfy the insurance needs of new projects, but also enhances the autonomy of insured users through the SaaS platform, thereby significantly reducing the threshold, addressing user pain points and avoiding the problem of low insurance capacity. Furthermore, customization enables iterative upgrading of insurance products, further reducing costs, improving efficiency and ultimately expanding the market size.

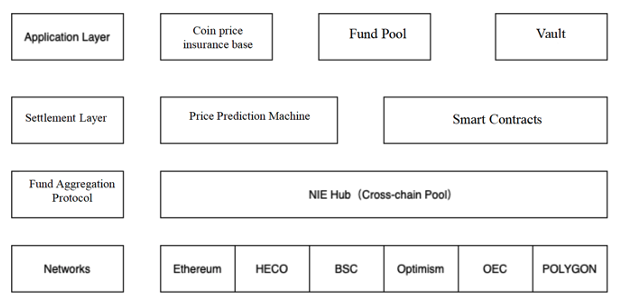

The NodeDAO platform consists of an application layer, a settlement layer, a pool aggregation protocol Networks, with complete functionality. It employs the NIE Hub cross-chain solution to address the problem of asset decentralization by mapping all assets with stablecoins to the BSC network, and the existing solution is made up of the O3 Hub cross-chain pool and polynetwork. These functional components have significantly reduced the cost of making insurance products, improved the efficiency of insurance, and broken the application bottleneck.

Dual drive for insurance investment through DAO governance

Besides personalizing the platform, NodeDAO also adopts DAO governance to further reduce costs and improve efficiency, including the governance of NodeDAO parameters (proportion of fees charged, determination of parameters of insurance pricing model, etc.), vault revenue dividends, token NEI increment, governance of cooperative projects and project development, etc. The governor can decide the directions of project development and resource investment via voting.

A large part of the cost of insurance involves loss assessment and settlement. Traditional centralized insurance suffers from problems such as unclear liability determination and unclear clause design, and invests heavily in risk control. NodeDAO introduces a three-step assessment approach. The new product launch part starts with assessment by experts, who are responsible for assessing the project risks and the need to output specific incident reports for community governors to assess the risks in case of contractual security issues. This is followed by a community-based evaluation, in which volunteers from the community further assess the evaluation based on an Advisory Board, and participating users are rewarded with INSUR tokens. It is finally subject to continuous updating and will continuously assess and adjust its risk level based on the data and information collected. Claims assessment will be handled jointly by the Advisory Board and the community claims assessors through surveys and community votes. Participating parties are coordinated through DAO governance to further improve efficiency.

In addition, full consideration is given to taking into account the sustainability of the benefits to the underwriters. For underwriters who provide underwriting funds, such a model is difficult to sustain if their revenue is not as satisfactory as the pledged revenue from other DeFi agreements. NodeDAO further enhances the returns of contractors and expands the source of funds for a dual drive of insurance and investment through DAO governance.

Contact Info:

Name: Edwin Borch

Email: Send Email

Organization: Blockmove Technology co.,ltd

Address: 16 Sandilands Road, Singapore, 54600, Singapore

Phone: +65 57886341

Website: https://nodedao.io/#/

Release ID: 89071567