San Rafael,United States – March 25, 2022 —

People have many different ideas about how to calculate return on investment for rental property. Many have a cloudy, even potentially dangerous notion of what a good return on investment for rental property truly is, and how it can be known before the investment is made. Many just consider the return on investment as the cash flow, but Adiel Gorel, Owner of International Capital Group who has invested in 1000s of homes personally and helped 1000s of regular folk enjoy what he calls in his book of the same title Remote Retirement Riches. There is a safer way to calculate where to invest.

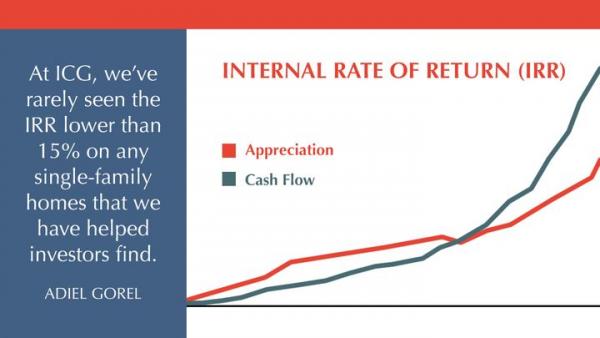

“How to calculate return on investment for rental property is very simple if the focus remains on the right numbers. Focus closely on the IRR, Internal Rate of Return. Here’s the part people skip, an investor can only look at the whole picture when they can see the entire picture.” Says Gorel.

So here’s the breakdown on how to calculate return on investment for rental property. It’s known how my money must be put down on the rental home. It’s known how much the closing costs will be on this rental home. All if not most of the regular expenses are known. And then anyone can calculate how many years they will hold onto the home. As a long-term holder, it is largely known the rents that will come in over the lifespan of the loan. The amount of the mortgage payments paid during that time, the average repairs that will take place, and all the expenses—and then it sells. Now all the numbers to focus on are known. How much it sold it for, the commission costs the closing costs. Plug those into an Excel sheet that actually has a function called X IRR, where you can get your internal rate of return, exactly. That’s the true, comprehensive measure of how to calculate return on investment for rental property. Then anyone from the first-time investor to the seasoned investor can easily see what is a good return on investment for rental property and make the decision to invest wisely.

“Good single-family homes in good areas sometimes seem like a boring investment, (which actually means no headaches) it’s a solid investment. And great things are only built on solid foundations.” says Adiel Gorel owner of International Capital Group.

That consistency makes possible a solid way to determine, what is a good return on investment for rental property and therefore if it should be invested in or not. While a property seems lower on cash flow at the beginning, the overall internal rate of return is usually very good. Remember, once the property is locked into a fixed 30-year mortgage, the forces such as inflation constantly are eroding the loan and making it tiny, while the tenant is paying it off with the rent month after month. Consistency gives an investor the peace of mind to make all of their other decisions. It’s an investment that can be relied on. And then eventually when it sells since it only costs the down payment, minimal wear and tear maintenance when the investor uses the internal rate of return they can easily see their wealth rise. At ICG, Adiel Gorel has rarely seen the IRR lower than 15% on any single-family homes that they’ve helped investors find. It’s vital to remember when determining how to calculate return on investment for rental property people have made the mistake of looking only at the initial cash flow which can lead to the impulse to buy in less desirable areas, to buy properties that need to be fixed up, properties that may or may not rise in value all in the name of getting cash flow in the moment. Why would anybody volunteer to buy not-as-good properties, in not as good areas, with not as solid of an economy as possible? Because they are simply focusing on the wrong numbers when determining how to calculate return on investment for rental property. Because on paper, the cash flow can seem very tempting. Life doesn’t happen on paper. Life happens in real-time. And so what happens when an investor buys bad properties because they think cash flow is the only return? They buy worse properties in worse locations, in worse conditions. And they are left wondering what is a good return on investment for rental property of that caliber. The results are always very congruent: worse tenants, worse rents, more evictions, and very likely more repairs. And all of a sudden, the focus on the initial “cash flow” is so much worse than focusing on the boring, beautiful financials of the property that brings in lower “to begin with ” cash flow but brings in a constant cash flow, a more predictable cash flow. And here’s the best part, overall a higher cash flow! When you buy nice properties, things go smoothly. That’s the whole principle behind Remote Control Retirement Riches. Focus on, internal rate of return, including absolutely everything—downpayment, selling price, and the cash flow in the middle. That is the true measure of what is a good return on investment for rental property. Do not get sucked into the common mistake of buying junk because it yields a small cash flow right away. That can quickly turn into a paper dream. Focus on newer properties, single-family homes in the sunbelt states, with a fixed 30-year mortgage and predictable rents. Boring is steady and steady is the foundation to remote control, retirement riches.

Visit ICGRE.com/guide to find out the best places to invest in real estate in 2022. Get details about how to calculate return on investment for rental property, and the best places to invest in 2022, Many people are surprised by how much clearer their decision is made by the answer. Being surprised is not a strategy, get answers, it can mean a huge difference to the bottom line.

Contact Info:

Name: Adiel Gorel

Email: Send Email

Organization: ALLUSA INVESTMENTS, INC

Address: 165 North Redwood Drive, Suite #250, San Rafael, CA 94903, United States

Phone: +1-415-927-7504

Website: https://icgre.com

Source: PressCable

Release ID: 89071911

If you detect any issues, problems, or errors in this press release content, kindly contact error@releasecontact.com to notify us. We will respond and rectify the situation in the next 24 hours.