The overall market size of China’s public cloud services (IaaS/PaaS/SaaS) reached 2.46 billion US dollars in Q1 2019 on a year-on-year increase of 67.9%. The data from the International Data Corporation’s (IDC’s) report in August once again locked the industry focus on SaaS (software-as-a-service), which has almost 10 times the development space. The SMEs (small and medium enterprises) SaaS vender RockySaaS Group Limited has been working on its business ecosystem and enlarging its services. Can RockySaaS (also as Rocky SaaS), known for the website authentication services, get a share in today’s fierce competition?

In terms of the global market, “the enterprise SaaS market in Q1 has generated over 23 billion US dollars of revenue for software vendors and will continue to grow at almost 30% per year,” according to a report issued by Synergy Research Group in June. Microsoft is the first ranked vendor in this market due to its high-growth collaboration segment. The second place goes to Salesforce which is the dominant player in CRM.

On the Chinese market, Alibaba and Salesforce announced a strategic partnership in July. “Alibaba will become the exclusive provider of Salesforce to customers in mainland China, Hong Kong, Macao, and Taiwan, and Salesforce will become the exclusive enterprise CRM product suite sold by Alibaba,” said Salesforce’s website. The combination of Alibaba’s IaaS and Salesforce’s PaaS will bring great benefits to Alibaba’s cloud services.

The China’s SaaS market has at least 10 times the development space. A joint report issued by Alibaba Cloud Research Center this year said, the number of Chinese companies is three times that of the US, but China’s SaaS output is only 24% of the US. If we divided the value of SaaS by the number of companies, it can be seen average revenue per user (ARPU) of companies in the Chinese SaaS market is 21.6 US dollars, compared with 255 US dollars in the US, which is 11 times that of China.

The enlightenment stage of China’s SaaS industry was in 2004-2005. Some companies at that time launched B/S architecture software instead of the traditional C/S architecture software, which became the prototype of Chinese SaaS products. However, since the concept of SaaS was still a new thing in China, most enterprises had very limited knowledge about this, and there were few actual purchases. The first wave of SaaS in China quickly returned to silence.

A few years later, the concept of cloud computing, which was suddenly being popular, brought SaaS back into the market. With the increasing awareness of “cloud” recently, the acceptance of SaaS has been continuously improved, which has led to a new wave of enthusiasm.

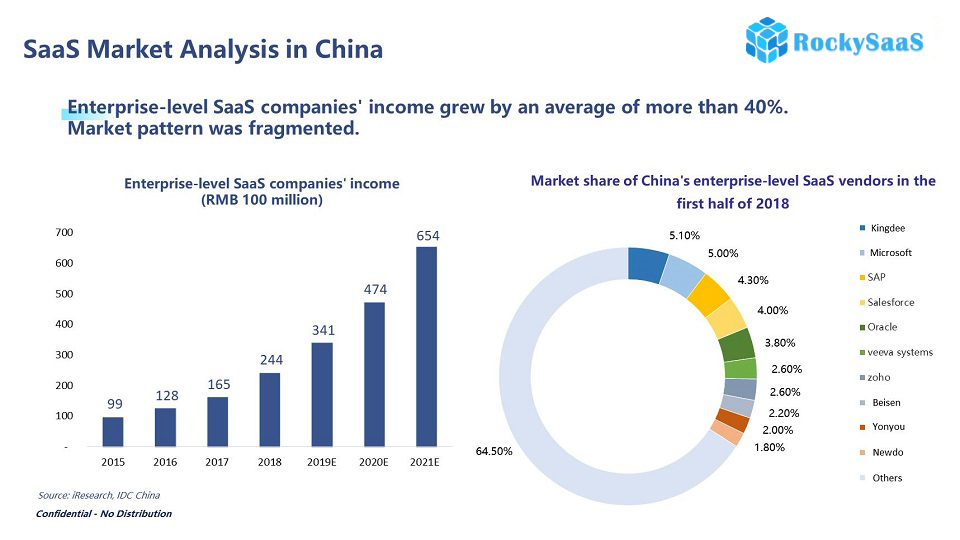

In 2021, the size of China’s SaaS market is expected to exceed 32.3 billion yuan, and the compound annual growth rate (CAGR) is expected to exceed 30% from 2018 to 2021 according to IDC.

On the whole range of SaaS market, Oracle, IBM, Cisco, Workday, ServiceNow and many other companies have already dominated SaaS market shares. How likely a “new entrance” will survive in such a competition? ”

“There will remain many opportunities for new market entrants,” Synergy has given the answer in its report, forecasting strong growth in SaaS market, and further emphasizing that such market is substantially bigger and will remain such growth until 2023.

When we launch a new SaaS product, we should first focus on the differentiated needs, and occupy the niche market to become a leader in the vertical fields and then slowly expand to other mainstream customers, said Su Zhixing, deputy general manager of Tencent Qidian, at a summit in August.

Taking the example of the CRM field that users are familiar with, Synergy indicated that the CRM segment has relatively low growth compared to other SaaS segments. The global SaaS CRM market size will grow by 33.15 billion US dollars during 2019-2023, according to the market research company Technavio’s report in July, adding the CRM market will register a CAGR of over 14% during the forecast period.

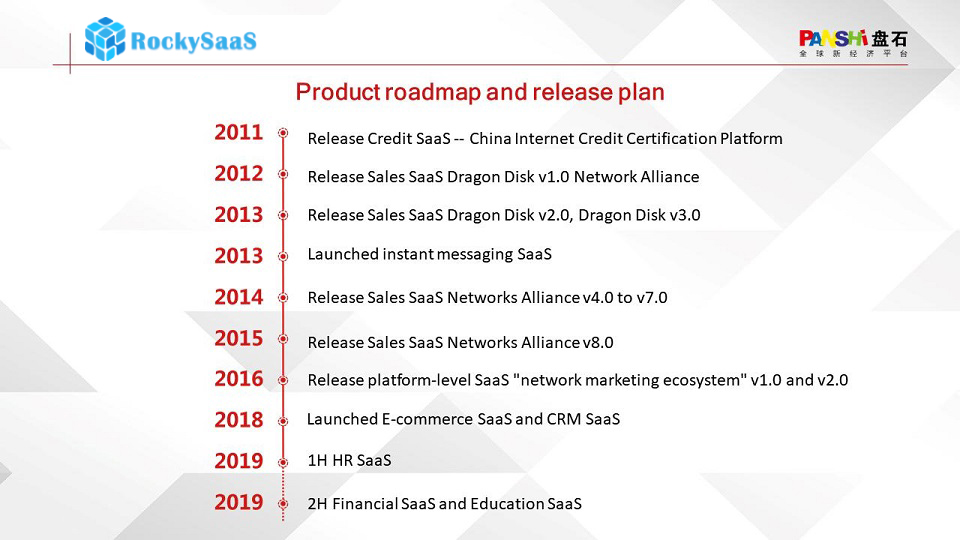

On China’s Internet market, one of the most popular services was credit certification for websites and apps. RockySaaS (RockySaaS Group Limited) is emerging in the credit arena by providing trusted authentication services.

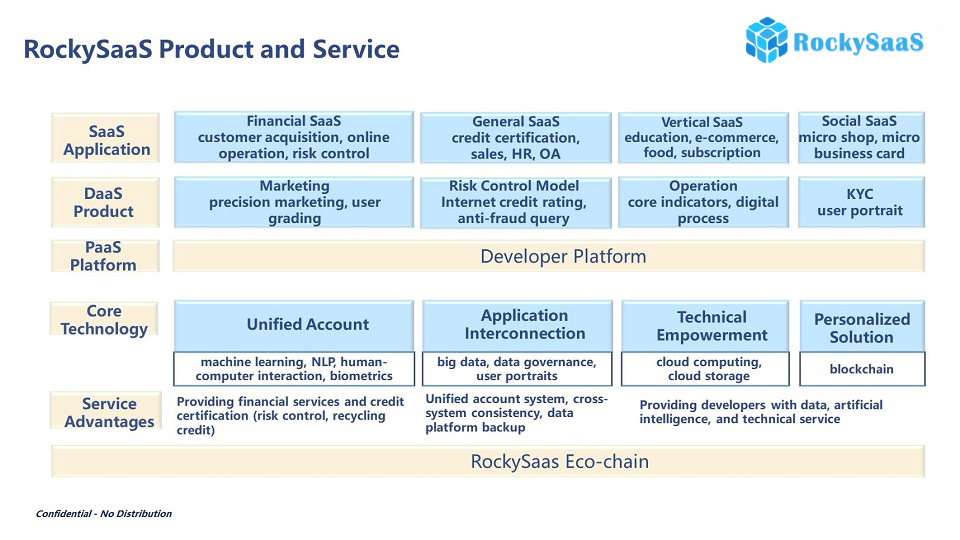

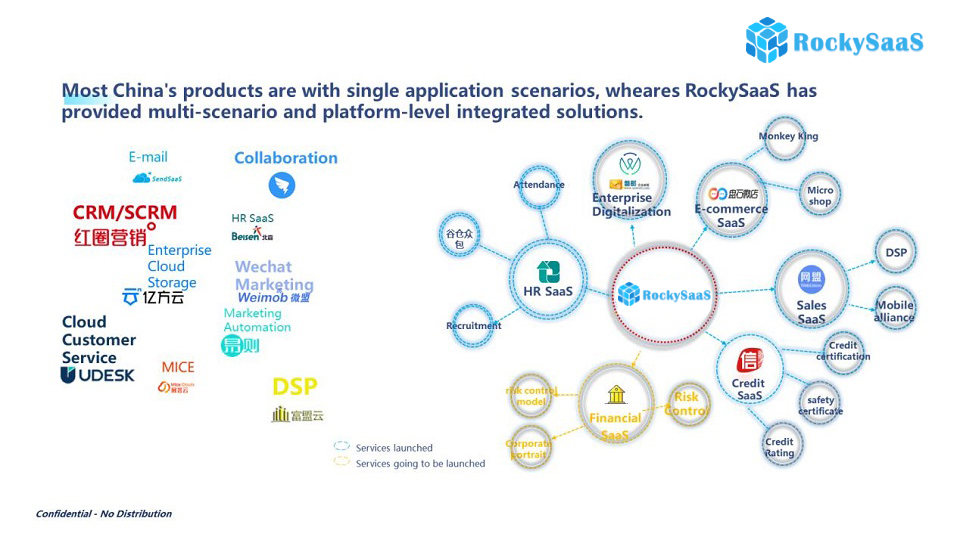

Noting the shortcomings of a single vertical SaaS product, RockySaaS is seizing opportunities in the huge SaaS market and has been enriching and developing its own SaaS products and platform. RockySaaS is committed to building a business ecosystem, providing digital, one-stop, multi-scenario SaaS solutions for SMEs.

Since 2011, RockySaaS, aiming at big data and artificial intelligence (AI) as core technologies, has built a platform with SaaS products such as E-commerce, CRM, Sales, Social, and HR for better reaching the SaaS market.

SMEs account for 99% of the Chinese cloud services market. Their needs are complex and often require higher and more flexible service. RockySaaS provides more effective solutions and targeted to solve their transformational problems. So far, RockySaaS has provided internet SaaS services to 2.6 million businesses, and has 8 invention patents and more than 90 software copyrights.

With the mode of “high profit, high production, high efficiency, and low cost”, RockySaaS has built the five-in-one integrated SaaS cloud service for all walks of life including web, wap, WeChat official accounts, mini program, and app.

RockySaaS is part of Panshi Group. Panshi was founded in 2004 by James Tian and is headquartered in Hangzhou, capital of Zhejiang Province. Panshi has branches and offices in cities such as Beijing, HongKong and Shenzhen, as well as in other 20 countries such as India, Indonesia, the Philippines, Malaysia, Brazil, South Africa, and Ukraine.

Signing ceremony between Panshi Group and an industrial venture capital fund in Huzhou this June.

Panshi, a global new economic platform, in June secured a strategic investment agreement of 401 million RMB from an industrial venture capital fund in Huzhou City in Zhejiang. The investment is a milestone for Panshi in its digital industrialization process among key cities in both China and abroad.

Panshi Software (Zhejiang Huzhou) Co., Ltd., a wholly-owned subsidiary of RockySaaS Group Limited, also settled in Huzhou City this June. The settle-in of RockySaaS will boost the transformation of Huzhou’s local traditional enterprises into digital economy, and promote the integration and innovation of the industrial digital economy.

Media Contact

Company Name: RockySaaS Group Limited

Contact Person: Turner Hua

Phone: +86 15910790575

Country: China

Website: www.adyun.com